Do you remember what a 70 percent top tax rate entailed? Neither do I. I was born in the last months of the Carter presidency, and while...

Do you remember what a 70 percent top tax rate entailed? Neither do I. I was born in the last months of the Carter presidency, and while I’ve certainly read about the effects his policies had, I didn’t experience them firsthand.

If Alexandria Ocasio-Cortez has her way, however, we might all be going back to those days. See, among the brilliant plans devised by the freshman congresswoman from the Bronx (who has remained ever eager to remind you that she is, in fact, from the Bronx) is to increase the top tax rate to 70 percent.

Ocasio-Cortez, as you may have heard, has been pushing her “Green New Deal,” which would essentially turn the government into a sort of Randian nightmare where central planning would eliminate our dependence on fossil fuels. She also wants to do this in 12 years, which makes the moon shot look like a piece of cake.

But where would the money for this come? Ocasio-Cortez suggested a tax rate of 60 to 70 percent on the top earners, according to Politico.

“What is the problem with trying to push our technological capacities to the furthest extent possible?” Ocasio-Cortez said during an appearance on “60 Minutes.”

“There’s an element where yeah, people are going to have to start paying their fair share in taxes.”

When Anderson Cooper called this “radical,” Ocasio-Cortez approved of this.

“I think that it only has ever been radicals that have changed this country,” Ocasio-Cortez said. “Yeah, if that’s what radical means, call me a radical.”

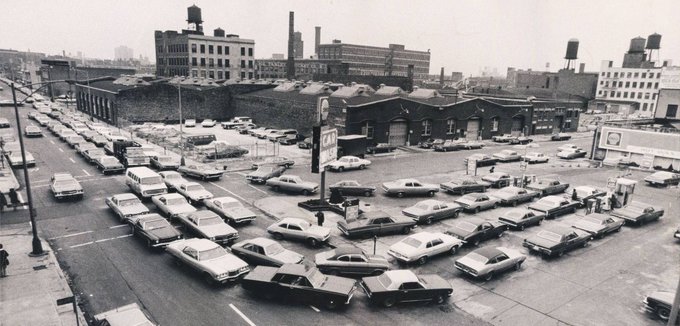

Except, as James Woods notes, it’s not really radical to go back to 1979:

Now, granted, the Iranian revolution was what caused the 1979-1980 oil shock, but this was emblematic of Carter’s policies. If you look at the administration holistically, it made sense.

For instance, Carter’s foreign policy was profoundly weak, one of the reasons why the Iranian revolution had such a profound impact on Americans. He’ll also forever be connected with the “misery index,” an economic indicator that was amazingly high under his administration — in no small part due to tax policy.

Oh yes, and “malaise.” Don’t forget malaise.

High taxes didn’t help then and they won’t help now. This is especially true when you consider the people who earn the kind of money Ocasio-Cortez wants to be taxing have incredible monetary mobility. That could mean by the time she gets around to taxing the 70 percent that she wants to, that money has long been burrowed away somewhere else.

And that’s not inconsequential. Consider data from the Tax Foundation, which found “(t)he top 1 percent paid a greater share of individual income taxes (39.0 percent) than the bottom 90 percent combined (29.4 percent).”

Then you look at the “Green New Deal,” which is really more a bunch of rhetoric than a plan. Once we mobilize the American economy for the purposes of eliminating carbon-based fuels within 12 years, as she wants to, what’s going to happen is systematic imbalances even greater than the Iranian revolution could provide.

Thus, if you thought that gas lines were bad before, wait until you see what Ocasio-Cortez wants to do. She’s no radical — at least, not unless you consider Jimmy Carter a radical.

"people are going to have to start paying their fair share in taxes.”

ReplyDeleteQuote from famous pol. "Don't tax you; don't tax me; tax that guy behind the tree."

There is a simple way to pay for everything we NEED. First NO ONE needs WAR. Some rich and powerful "people" WANT war because war makes them more money than almost any of the other illegal ways they make money,

THEN, each year, write a LINE ITEM BUDGET that allocates the revenue expected to the line items. This budget will always BE MADE to balance. The line items will include EVERYTHING even the so called black budget. There will be NO BORROWING. Our spineless Congress must CHOOSE.