Elon Musk just ignited a firestorm of controversy when he announced Tesla would not longer accept Bitcoin due to the environmental concern...

Elon Musk just ignited a firestorm of controversy when he announced Tesla would not longer accept Bitcoin due to the environmental concerns related to Bitcoin mining and its gargantuan energy consumption.

The pro-Bitcoin community erupted in a fierce backlash, claiming that most of Bitcoin’s energy usage comes from renewables, and that the more energy Bitcoin uses, the better it is for the world. As you might have suspected, however, both claims are patently false.

Bitcoin uses enormous amount of energy, and most of it does not come from renewables, as you’ll see here. Such claims are little more than propaganda from Bitcoin propagandists who need to keep burning more coal to power their enormously wasteful Bitcoin mining ecosystem… but they want to pretend it’s all somehow “green.”

Bitcoin uses about half the electricity of the entire nation of Australia

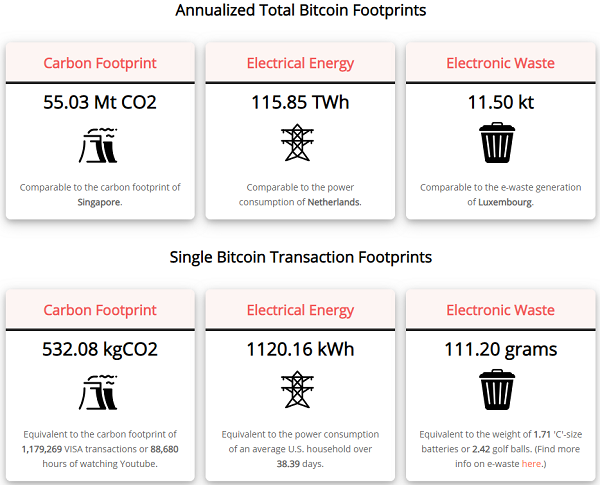

Bitcoin mining currently consumes over 115 terawatt-hours per year, according to Digiconomist research, meaning Bitcoin consumes more energy than the entire nation of the Netherlands. Bitcoin uses so much electricity that it could power nearly half the electricity usage of the entire nation of Australia.

Bitcoin operations also produce more CO2 than the nation of Singapore (over 55 Megatons per year), and over 11 kilotons of electronic waste.

Shockingly, every single Bitcoin transaction has a “footprint” of using over 1,100 kWh of electricity, which is the amount of power that a typical U.S. household would consume in about 38 days, explains Digiconomist:

The continuous block mining cycle incentivizes people all over the world to mine Bitcoin. As mining can provide a solid stream of revenue, people are very willing to run power-hungry machines to get a piece of it. Over the years this has caused the total energy consumption of the Bitcoin network to grow to epic proportions, as the price of the currency reached new highs.

Why does the Bitcoin ecosystem use about 38 days’ worth of household electricity for every Bitcoin transaction, on average? The answer is found in Bitcoin mining — an activity that uses vast amounts of electricity to carry out “proof of work” processing that has no real value in the real world and produces nothing of use outside the Bitcoin system of virtual “value.” The entire purpose of this “proof of work” is to engage in artificial difficulty to make it extremely costly for anyone to try to game the system with counterfeit blockchain ledger entries. So the massive use of electricity doesn’t actually produce anything except excess heat. It merely serves as a disincentive against the system being rigged by bad faith cyber operators.

As explained in a Bitcoin mining science paper announcement published on Eurekalert.org:

Bitcoin “miners” guarantee a system without fraud by validating new transactions. Miners solve puzzles for numerical signatures, a process that requires enormous amounts of computational power. In return, miners receive Bitcoin currency.

That means Bitcoin has managed to invent the world’s most expensive and wasteful security system ever created. 115 terawatt-hours per year seems outrageous. Remember, this much electricity could power about half the country of Australia. Is it really necessary to burn this much electricity just to keep Bitcoin secure?

Bitcoin footprint data via Digiconomist.net

Bitcoin proponents falsely claim it’s all powered by 75% renewable energy

Bitcoin proponents don’t disagree that Bitcoin uses vast amounts of electricity, but they argue it mostly comes from renewable energy. This claim — repeated by Zero Hedge and Anthony Pompliano — is based entirely on a flawed “study” from a pro-Bitcoin propaganda group called Coinshares. Much of the Coinshares website reads like it was written by Bitcoin fundamentalist zealots. The company doesn’t even pretend to be unbiased or critical in its thinking about Bitcoin.

In fact, Coinshares actually writes, “It is in our interest to consume more energy not less.”

You read that correctly: They want Bitcoin to use as much energy as possible. This is good for the world, some Bitcoin proponents argue, and if Bitcoin uses more energy than all the countries on planet Earth combined, that can only be good for Bitcoin profits.

The problem is that Coinshares has zero credibility as a research organization and is wildly biased toward a pro-Bitcoin worldview. Its claimed research on hydropower sources for Bitcoin mining in China turned out to be quackery.

As Digiconomist explains:

One can argue that specific locations in the listed countries may offer less carbon intense power. In 2018 Bitcoin company Coinshares suggested that the majority of Chinese mining facilities were located in Sichuan province, using cheap hydropower for mining Bitcoin. Subsequent studies have, however, never been able to support this claim and/or found the opposite. Confronted with this evidence, the lead author of the Coinshares paper had to admit “mistakes” were made.

While Coinshares claimed that most Bitcoin mining was taking place in Sichuan province where hydropower dominated the local power supply, they failed to account for the fact that hydropower is seasonal in Sichuan. There’s only hydropower during the rainy season. When the hydropower runs dry — which happens every year — Bitcoin miners shift back to coal, which remains the predominant fuel source powering China’s vast power grid.

As Digiconomist explains, “The main challenge here is that the production of hydropower (or renewable energy in general) is far from constant. In Sichuan specifically the average power generation capacity during the wet season is three times that of the dry season. Because of these fluctuations in hydroelectricity generation, Bitcoin miners can only make use of cheap hydropower for a limited amount of time.”

Pompliano doesn’t seem to be aware of any of this, and Zero Hedge unfortunately contributes to the disinformation by implying that Pompliano is correct when he’s actually citing a debunked, discredited piece of flawed research from Coinshares.

But this behavior seems rather typical from the Bitcoin world, where “research” that gets touted is whatever research helps greenwash Bitcoin’s atrocious record on polluting the world with fossil fuels. Zero Hedge writes that it’s “nonsensical” to think Bitcoin isn’t good for the environment, for example.

Legitimate research reveals the shocking reliance on fossil fuels to power Bitcoin

The real research on this topic — conducted by actual scientists rather than Bitcoin propagandists — was published in the journal Joule in 2019. Its author is Christian Stoll, a researcher at the Center for Energy Markets at the Technical University of Munich, Germany, and the MIT Center for Energy and Environmental Policy Research.

The Stoll research into Bitcoin’s actual energy sources was extensive. Eurekalert covered the press release about this research in this article: Empirical energy consumption model quantifies Bitcoin’s carbon footprint. It explains:

Stoll and his team used IPO filings disclosed in 2018 by all major mining hardware producers to determine which machines miners are actually using and the power efficiencies of these machines. They also used IP addresses to determine emissions scenarios for actual mining locations and compare carbon emissions from power sources used by Bitcoin miners in different locations. Finally, they calculated Bitcoin’s carbon footprint based on its total power consumption and estimates from different emissions scenarios. These include a lower limit scenario, in which all miners use the most efficient hardware; an upper limit scenario, in which miners behave rationally by disconnecting their hardware as soon as costs exceed revenue; and a best guess scenario, which accounts for the anticipated energy efficiency of the network and realistic additional energy losses from cooling and IT hardware.

“Our model reflects how the connected computing power and the difficulty of Bitcoin search puzzles interact, and it provides a high precision of power consumption since it incorporates auxiliary losses,” says Stoll. “However, the precision of our results strongly depends on the accuracy of the input data, such as the IPO filings for hardware characteristics. The carbon emissions strongly depend on the assumed carbon intensity of power consumption.”

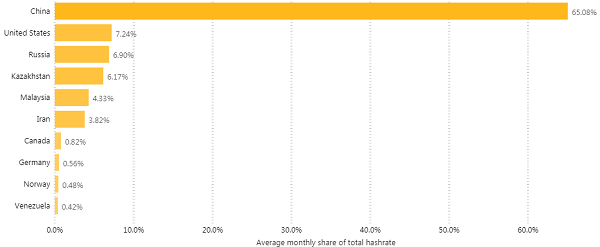

Additional research carried out by University of Cambridge scientists pursued an even more detailed map of energy usage that powers Bitcoin mining. It found that China accounts for about 65% of Bitcoin mining. As Digiconomist explains, the mapping of these regions reveals that, indeed, the vast majority of Bitcoin mining is taking place in the highest polluting regions of China, including in the dry season when the local grid is powered by goal, not hydropower:

Using a similar approach, Cambridge in 2020 provided a more detailed insight into the localization of Bitcoin miners over time. Charting this data, and adding colors based on the carbon intensity of the respective power grids, we can reveal significant mining activity in highly polluting regions of the world during the Chinese dry season (as shown below). On an annual basis, the average contribution of renewable energy sources therefore remains low. When Cambridge subsequently surveyed miners (also in 2020), respondents indicated only 39% of their total energy consumption actually came from renewables.

As The Economic Intelligence Unit also explains, Bitcoin miners can’t rely on hydropower because it’s both seasonal and unpredictable even during the wet season:

Bitcoin miners have adapted to using energy sources seasonally, utilising mining facilities in those two provinces during the wet season and relocating to Inner Mongolia and Xinjiang—where coal and wind power sources are abundant—in the dry season.

In addition, the largest Bitcoin miners in China are moving away from hydropower because it’s not reliable. As explained in an article on Medium.com:

Today, Chinese mines not only seek out cheap electricity, but also stability and scale. So instead of siphoning surplus electricity from hydropower stations in Sichuan, say, during the rainy season, larger mines are now partnering with local governments for a steady but discounted supply of energy from the State Grid, China’s state-owned electricity utility.

Bitcoin hash rate by country, via University of Cambridge Bitcoin Electricity Consumption Index

Only 39% of Bitcoin mining comes from renewable energy, not 75%

The Cambridge survey of Bitcoin miners reveals that even in their own self-reporting by Bitcoin mining groups, only about 39% of Bitcoin energy comes from renewables. That’s far from the 75% claimed by Bitcoin advocate Anthony Pompliano. And it debunks the entire “Bitcoin is clean” narrative from self-deluded Bitcoin propagandists who seem to cling to a cult-like mentality of filtering out legitimate data when it comes to supporting their Bitcoin profits, no matter what contortions are required.

In this case, it turns out that Elon Musk is right. Bitcoin is dirty. It’s not even the CO2, since CO2 actually helps grow plants and produces food from food crops. Rather, it’s the mercury pollution and particulate pollution that comes from coal. It’s also the environmental destruction and ecological degradation ties to coal mining operations. Pollution is the real factor that matters here, since China’s coal emissions are carried by winds, blanketing North America. This means pollution in cities like Los Angeles is actually derived, in part, from coal-powered Bitcoin mining in China.

And it begs the question: All for what?

Despite its humble beginnings as an experiment in decentralized money, Bitcoin is now in an irrational, Ponzi-like bubble rooted in FOMO desperation and extreme denials of reality. While a stable, decentralized cryptocurrency that actually maintains prices stability has real utility in terms of its portability and decoupling from the fake fiat central banks of the world, the mass hysteria surrounding crypto speculation and get-rich-quick vision of greed are sure signs that this digital tulip mania is a castle made of sand. When it topples, there won’t be much left to salvage.

In the end, Bitcoin will be viewed as a fascinating computational and psychological experiment that expended unimaginable fossil fuel resources, only to end up leaving most participants penniless. When the madness finally bursts and people come to their senses, Bitcoin’s end game value will be almost nothing compared to the vast resources the grand global experiment has unwisely consumed.

No one on Earth will be better off when this scheme runs its course, because Bitcoin produced nothing other than pollution, electronic waste and excess heat. It did not power any actual work and it did not produce housing, transportation, food or consumer goods of any kind. It did, of course, result in a mountain of electronic waste, and it consumed the attentions of millions of human beings who bought into the digital tulip mania scheme.

But like all such manias, this too will pass. And in the end, as people come to their senses, many will ask the obvious question, “We burned HOW MUCH COAL to fool each other into thinking we were all getting rich?”